idaho tax rebate fund

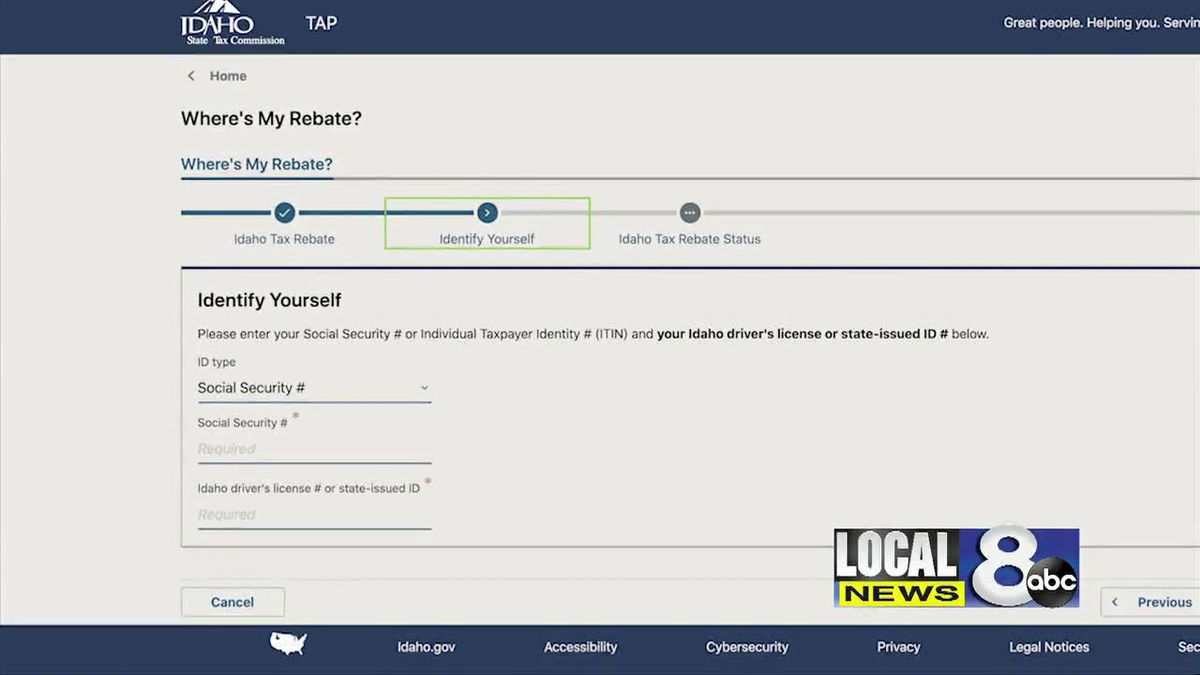

The refund status graphic tracks a returns progress through four stages. Idaho taxpayers can calculate their rebates by looking at the income tax they paid in 2020 on last years state tax.

One Time Tax Rebate Checks For Idaho Residents Klew

A small amount of the sales tax increase 02 plus 126 million in funding from the states general fund budget would go toward paying for the increase in the grocery tax credit.

. 3 visions regarding the income tax on individuals estates and trusts 4 and to make a technical correction. The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and decrease to 10 in 2024 for commercial size projects. The bill would also increase the tax credit Idahoans receive for groceries from 100 to 175 per person.

Track refund progress 247. The payments will go out to any full-year resident in 2019 and 2020 who filed individual income tax return or a grocery credit refund according to the tax rebate FAQ. 9 of the tax amount reported on Form 40 line 20 or line 42 for eligible Idaho residents and service members using Form 43.

Visit our refund status page to get the most up-to-date information on your 2021 tax return. - flyer for Idaho taxpayers 12-19-2019 Respond rapidly for faster refund. Each person will get a minimum of 50 and another 50 for each dependent.

0421 Introduced read first time referred to JRA for Printing. The tax cut and rebate are mostly being paid for with money from Idahos tax relief fund Republican Rep. Section 63-3024B - 2021 IDAHO TAX REBATE FUND 1 There is hereby created in the state treasury the 2021 Idaho tax rebate fund for the purpose of implementing the provisions of this section.

The continued costs of the bill would be paid for by the Idaho tax relief fund which takes sales tax from online sales as well as close to 60 million a. Up to two hundred twenty million dollars 220000000 less administrative costs shall be distributed by the state tax commission to pay rebates to individual taxpayers as. New for this year taxpayers can donate their rebate back to the state.

50 per taxpayer and each dependent. The one-time rebates will go to full-time Idaho residents who filed income tax returns in 2019 and 2020. Reducing individual and corporate income tax rates would cost 251 million annually starting in 2023.

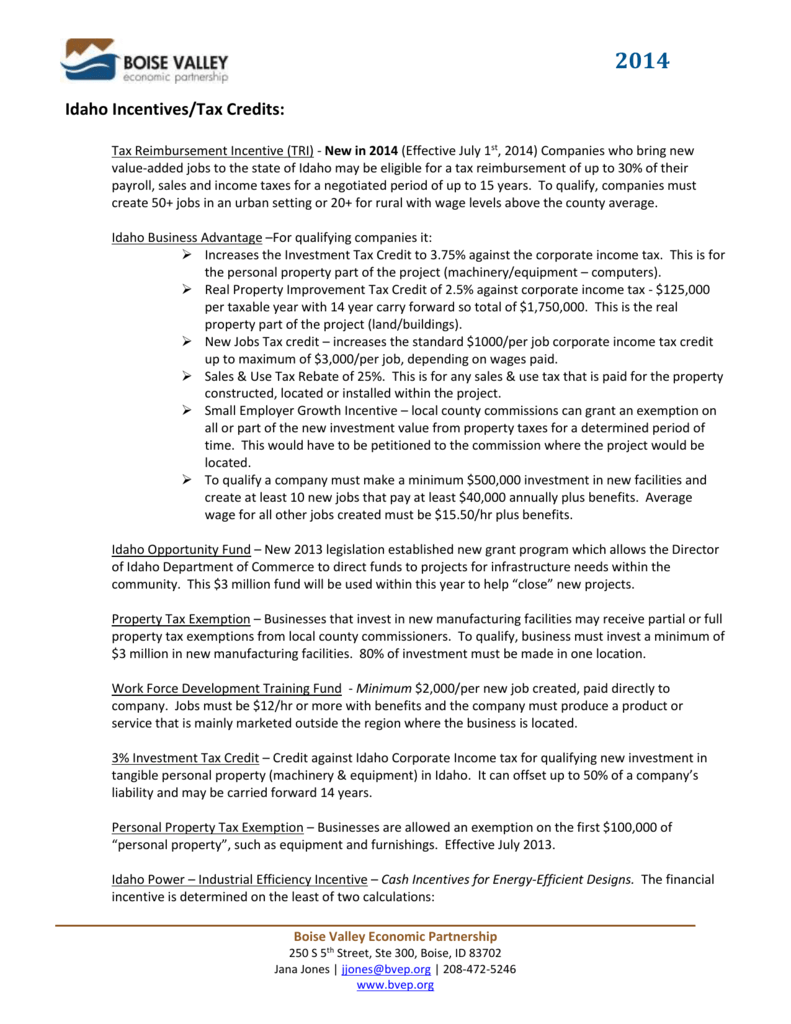

The Tax Reimbursement Incentive TRI is a performance-based incentive featuring a tax credit of up to 30 for up to 15 years on new state tax revenues generated by companies seeking to expand in or relocate to Idaho by adding new qualifying jobs. Federal Renewable Production Tax Credit for Land-Based Wind. Wheres My Refund video.

That income level would see a 328 rebate and about a 113 ongoing tax cut assuming the individual. The rebate is equal to approximately 9 of the tax amount reported on 2019 Form. Of the 169 million in ongoing income tax cuts 110 million is from the tax relief fund.

Its estimated to bring in 110 million a year. In May Gov. Boise Idaho Idahoans will begin receiving direct deposits or mailed checks in the form of income tax relief starting next week following the passage of Governor Brad Littles historic tax relief package earlier this year.

Or they could get 9 of the amount of state income tax they. This fiscal year it will be about 135 million. The income tax rebates would cost 350 million and go out to Idaho taxpayers in 2022.

For more information on the tax rebates visit the Idaho State Tax Commission website. TAXATION Amends and adds to existing law to revise provisions regarding income taxes to revise provisions regarding the Tax Relief Fund and to establish the 2021 Idaho Tax Rebate Fund. But they also approved a one-time tax rebate for full-time residents who filed income tax returns in 2019 and 2020.

We are making Idaho even more business friendly and competitive House Bill 436 provides 350 million of tax relief through a one-time tax rebate this spring and 251 million in ongoing tax relief beginning in July by lowering income tax brackets. The tax relief fund collects sales tax from online purchases. There will be no credit for small-scale solar by 2024.

From that total 94 million would come from the states tax relief fund which is funded by sales tax. Brad Little signed house bill 380 which created the 2021 Idaho Tax Rebate Fund. Each person will get either a minimum of 50 plus 50 for each dependent or 9 of the.

The median annual income in Idaho is 55785 according to data from the US. On February 4 2022 Governor Little signed House Bill 436 that provides another tax rebate to full-year residents of Idaho. Boise Idaho Idahoans will begin receiving direct deposits or mailed checks in the form of income tax relief starting next week following the passage of Governor.

Amending chapter 30 title 63 5 idaho code by the addition of a new section 63-3024b idaho code to 6 establish provisions regarding the 2021 idaho tax rebate fund. In all the deal will cost the state 3829 million 1629 million of which will be ongoing. Amend-7 ing section 63-3025 idaho code to revise provisions.

And 8 million in ongoing property tax cuts offset by the General Fund. The income tax relief will be sent out either via. Funding for rebates would come from the states projected 19 billion surplus.

Specifically the rebate will amount to 12 of their 2020 income tax bill. Its one of the following whichever is greater. The amount is based on the most recent approved 2019 tax return information on file at the time the rebate is issued.

The tax cut and rebate are mostly being paid for with money from Idahos tax relief fund Republican Rep. The refunds are part of Governor Littles Building Idahos Future plan to use our record budget surplus for tax relief and key investments in. Idaho Tax Reimbursement Incentive.

Check out our 2022 Tax Rebate video and find answers below to frequently asked questions about the tax rebate including how to donate your rebate.

What S This Wayfair Fund I Keep Hearing About Idaho Reports

Idaho Tax Commissioners Delay Income Tax Filing Deadline Boise State Public Radio

Idaho Residents Start Seeing Tax Relief Money

Idaho House Approves Massive Income Tax Cut And Rebate Plan Bonner County Daily Bee

Idaho Governor Brad Little Signs Leading Idaho Income Tax Relief Bill Idaho Bigcountrynewsconnection Com

Idaho Governor Signs Record 600m Income Tax Cut News Postregister Com

How Much Is Your Rebate New Idaho Law Will Give 600 Million In Income Tax Cuts East Idaho News

Record 600m In Idaho Tax Cut Heads To Governor S Desk Idaho News Us News

How To Track Your Tax Rebate Local News 8

Idaho Incentives Tax Credits Boise Valley Economic Partnership

Dems Pitch Alternate 600 Million Plan Decry Hb 436 The House Passed Income Tax Cut And Rebate Bill Eye On Boise Idahopress Com

Idaho Residents To See Tax Relief Money As Soon As Next Week East Idaho News

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho State Tax Commission News From The States

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

How Much Is Your Rebate New Idaho Law Will Give 600 Million In Income Tax Cuts East Idaho News

600 Million Income Tax Proposal Heads To The Idaho House Floor